Executive Summary

Since we started analyzing billions in sales pipeline four years ago, our focus has evolved. We’ve observed how sales performance is trending. We’ve scrutinized the factors influencing revenue. This year, we seek to understand how these factors lead to revenue.

In our 2023 report, we looked at sales performance through the lens of high-performing businesses. We observed the trends hidden within their sales data that were underlying their success. There were five key factors influencing their growth: deal qualification, time, relationships, engagement, and personas.

When we released our H1 update midway through 2023, the way we looked at the data changed. Our analysis showed us why high- performance teams were performing more effectively—but not how.

On the surface, sales performance had improved. However, over two-thirds of salespeople failed to make quota. More than a third of deals were slipping. The gap between top-performing reps and their peers was vast. So when we started our analysis of the fourth B2B Sales Benchmark Report, we started by questioning why.

This year we analyzed 4.2 million opportunities, 1m+ hours of conversations, from 530 companies, representing over $54 billion in revenue. Through the report, we explore the sales landscape as B2B Sales Benchmark Report 2024 we enter 2024 and what attributes define top-performing sellers across the B2B.

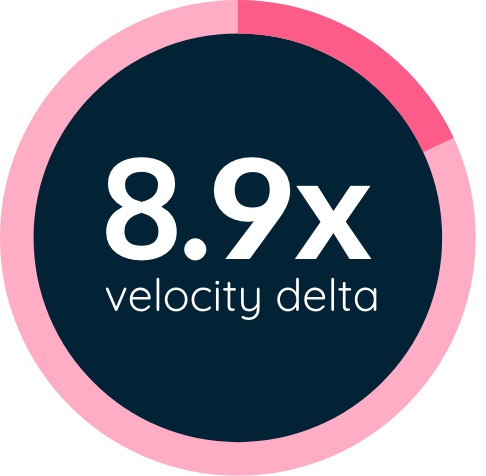

We explore these attributes using sales velocity as our ultimate measure so we can account not just for the value they generate— but also the speed and efficiency with which they do it. To be more representative, our analysis considers small, medium, and enterprise sales processes (a breakdown of what we analyzed can be found in the appendix).

Throughout each stage, we have introduced ‘spotlights’ to highlight examples of how top performers demonstrated this attribute—as well as the impact it had on their performance.

Every year we run this analysis, we learn more about what it takes to predictably and sustainably improve sales performance. This year was no different. We’re excited to share our findings that are not only relevant for sales leaders—but for the entire revenue organization. Our analysis will continue throughout 2024, so if you want to ensure you don’t miss the next release—please follow us on LinkedIn, subscribe to our newsletter, or check out the Revenue Insights podcast.

Without further ado, let’s begin.

4.2 Million

Opportunities

$54 Billion

Revenue

530

Of the world's best

performing companies

1 Million+

Hours of conversations

State of Sales in 2024

A bear market gripped B2B sales teams through 2023. Despite encouraging improvements in H1 (win rates +7%, sales cycles +16%, average deal values +9%), the ‘new normal’ stabilized by the end of H2.

Businesses were still buying through 2023; however, as budgets tightened, win rates declined (

So while deals continued to close, sales teams had to work harder to get them over the line. Sales cycles grew

Lack of budget has been an all-too-common objection facing sellers in 2023, and tighter budgets were a recurring theme, with average deal values decreasing by

Rep Performance

Despite a strong start in H1 2023, 73% of reps missed quota in H2. Now, in 2024, on average, 69% of reps are falling short.

On the surface, this is an improvement. However, upon questioning why, average quota targets were smaller (

Businesses increasingly depend on their top performers, with an

Performance gaps were driven by a rise in delayed deals, with

Attributes of Top Performers

In any bear market, while many struggle, the opportunity is vast for those who get it right. Across 2023, 31% of reps exceeded quota. It’s these reps we can learn from to understand what is working (and therefore should invest more into) and what is not (and what we should cut back).

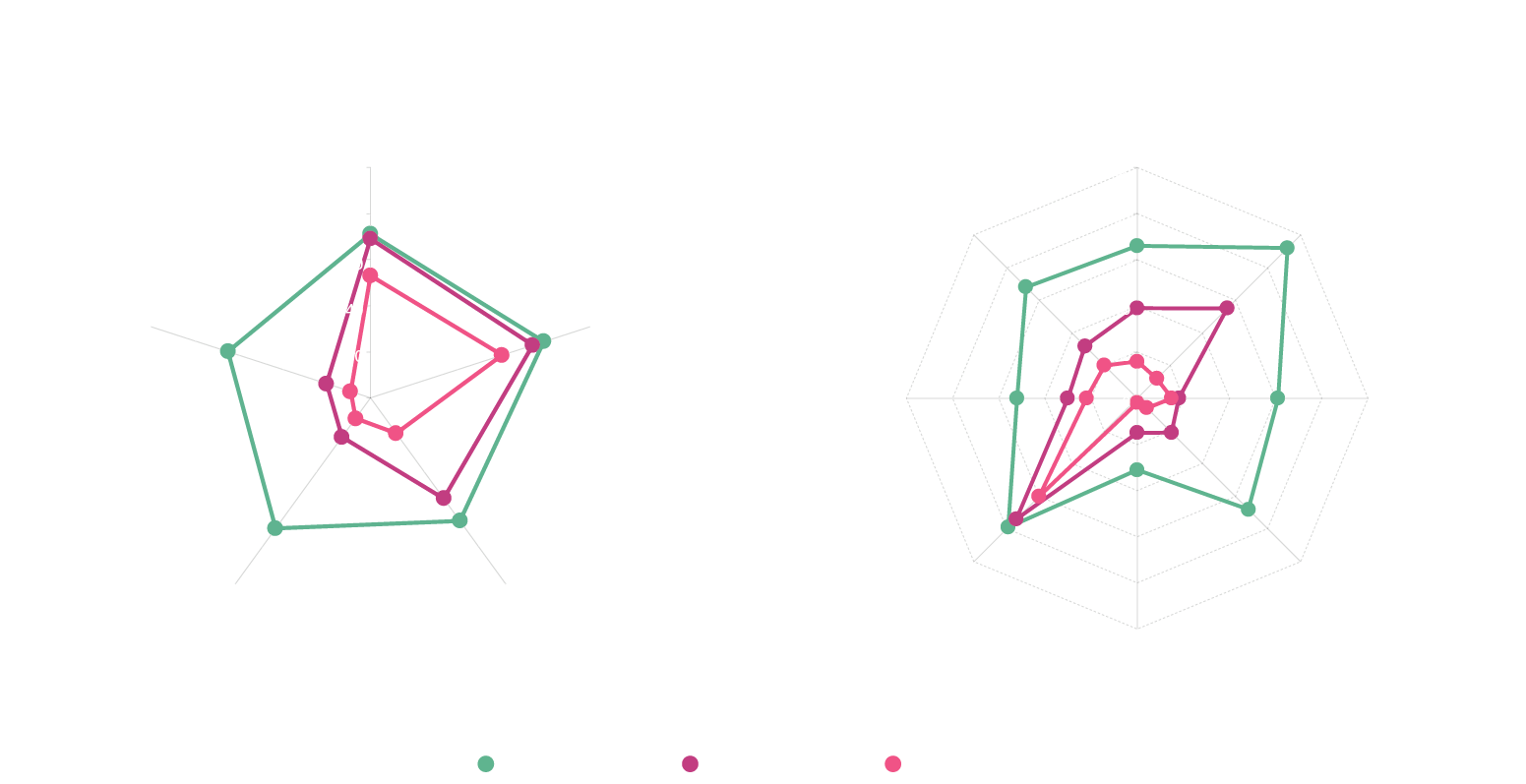

The difference between top and average- performing reps can be seen through

five key attributes: pipeline generation, qualification, objection handling, relationship management, and deal management.

Pipeline Generation

When prospecting, top performers prioritize the right accounts and personas to make the most effective use of their time. For example, the best-performing personas saw a

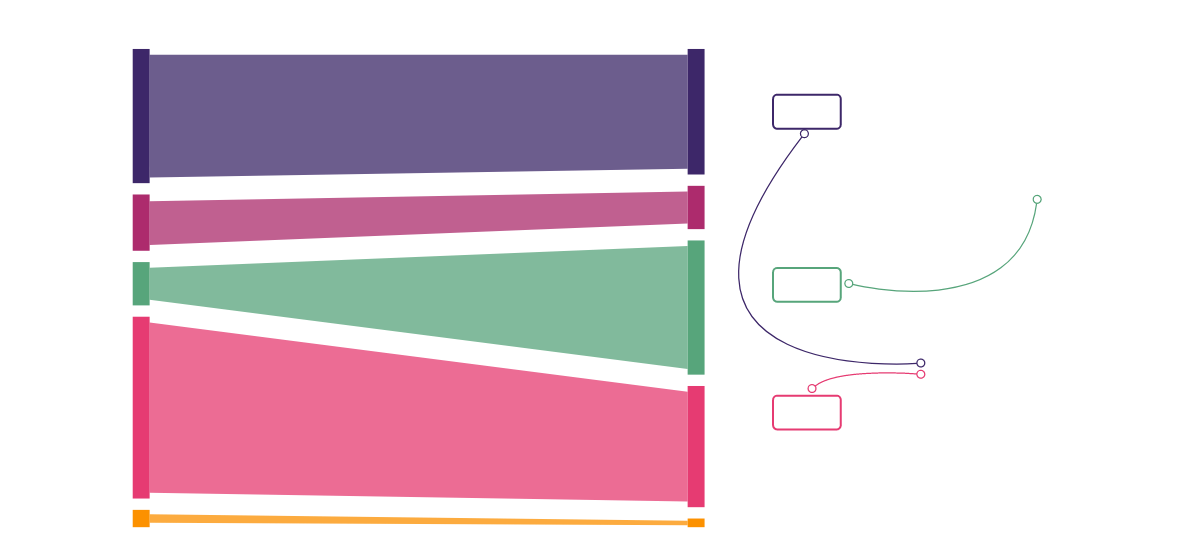

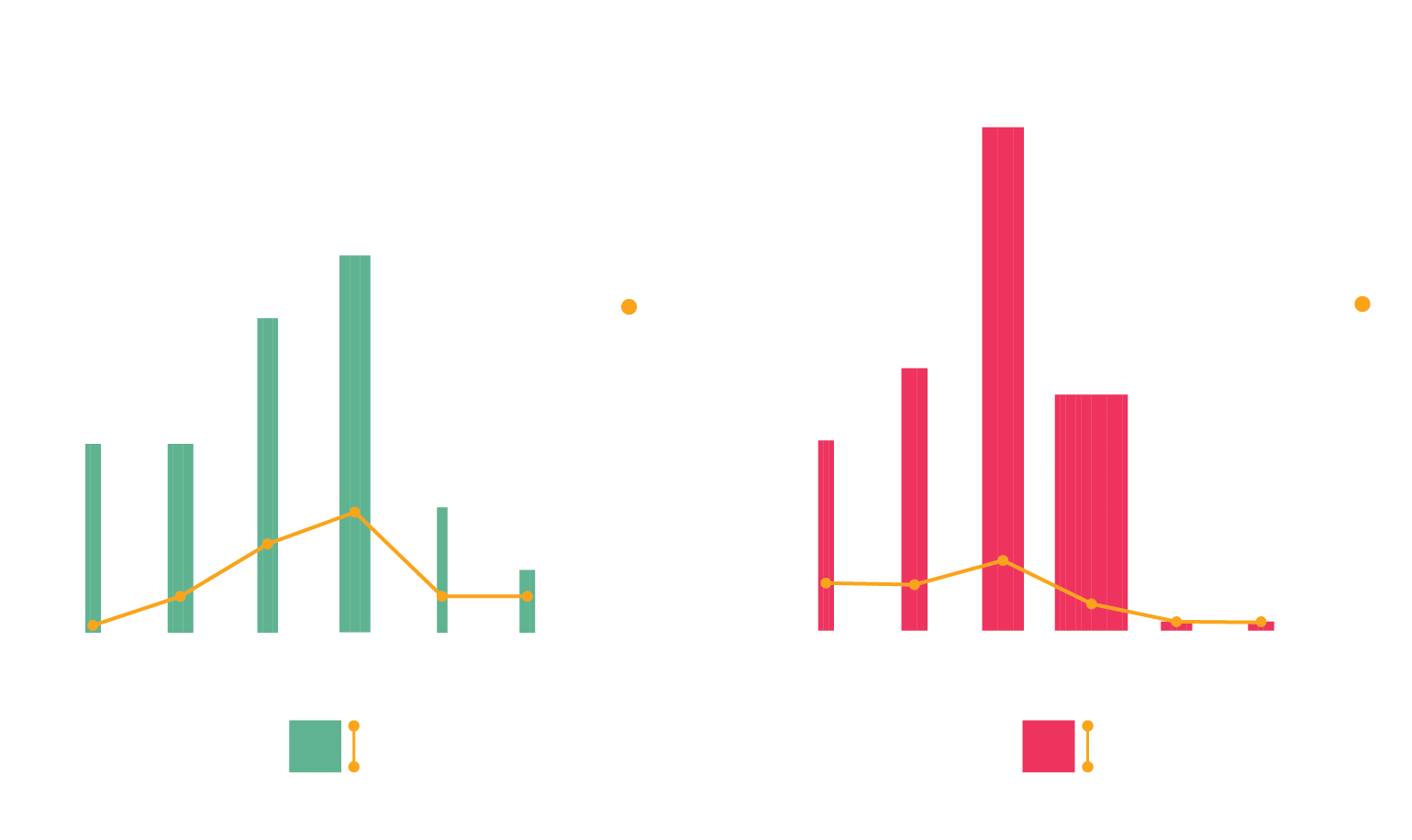

The source of leads is often overlooked by reps. As shown by the graph, the returns from channels such as partnerships (

Insights:

Organic inbound is the best-performing source for companies with 500+ employees, boasting high win rates and fast sales cycles, improving velocity by

Outbound is the best-performing source for companies with fewer than 500 employees, where average deal values are

The VP Finance is not the ‘bogeyman’. Across all analyzed personas, deals involving this persona had the third- highest velocity. For closed-won deals, finance leaders were facilitators. The challenge lies in determining when to involve them—i.e., not too early or too late.

Advice on improving performance

Top performers prioritize sources of revenue, not pipeline

Want to improve the quality of pipeline?

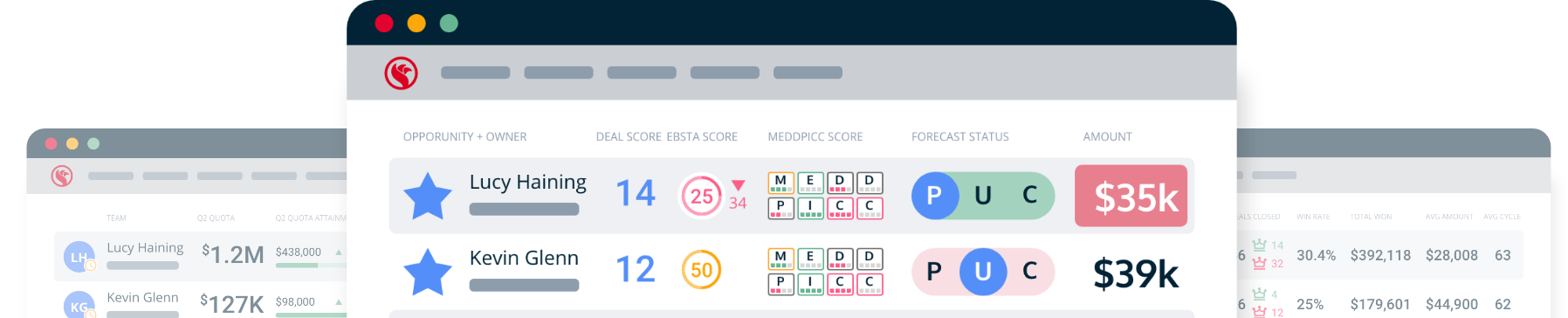

Ebsta helps improve the effectiveness of pipeline management process

Qualification

Once prospects are engaged, top performers are

Top performers are diligent with their pipeline. They use a qualification methodology to evaluate whether the prospect will be a good fit as a customer. As such, top performers are

Qualification for top performers is not just a ‘checkbox’ exercise. Their discovery lays the foundation for a proactive sales process. For example, many methodologies will focus on identifying the key decision makers. Top performers use this insight to engage these contacts early with relevant messaging. Compared to average performers, the top reps are

Insights:

SPICED

- 4.7 meetings to get > 80% SPICED

- 3.4 contacts

307% more likely to win deal if SPICED completed by Solution Presented stage- Top performers

349% more likely to have SPICED completed

MEDDPICC

- 5.6 meetings to get > 80% MEDDPICC

- 5.2 contacts

-

324% more likely to win deal if MEDDPICC completed by Solution Presented stage - Top performers

361% more likely to have SPICED completed

Advice on improving performance

Top performers are 588% more likely to follow methodology effectively

Want to improve adoption of your methodology?

Ebsta uses AI to qualify deals and surface those insights in deal reviews

When Objections Arise

Handling objections is a critical skill for sellers. Not only does it enable them to overcome initial reservations, but it also helps them to build compelling business cases. After analyzing over 1 million hours of sales conversations, we now know just how critical a skill it is for top performers compared to their peers. Top performers are 843% more likely to overcome objections.

The majority of objections occur early in the sales process. These objections present obstacles and potential opportunities for sellers. Of every slipped opportunity - 77% featured key objections being raised early in the process.

As we will see later in this chapter, objections can quickly become a hurdle that average performers are unable to overcome. Whereas top performers are more likely to overcome them, and accelerate deals forward as a result.

Insights:

Top performers

77% of slipped opportunities had objections raised early in the sales process

Want your reps to handle objections more effectively?

Ebsta helps identify the objections that reps struggle most with

Why Reps Close Lost Deals

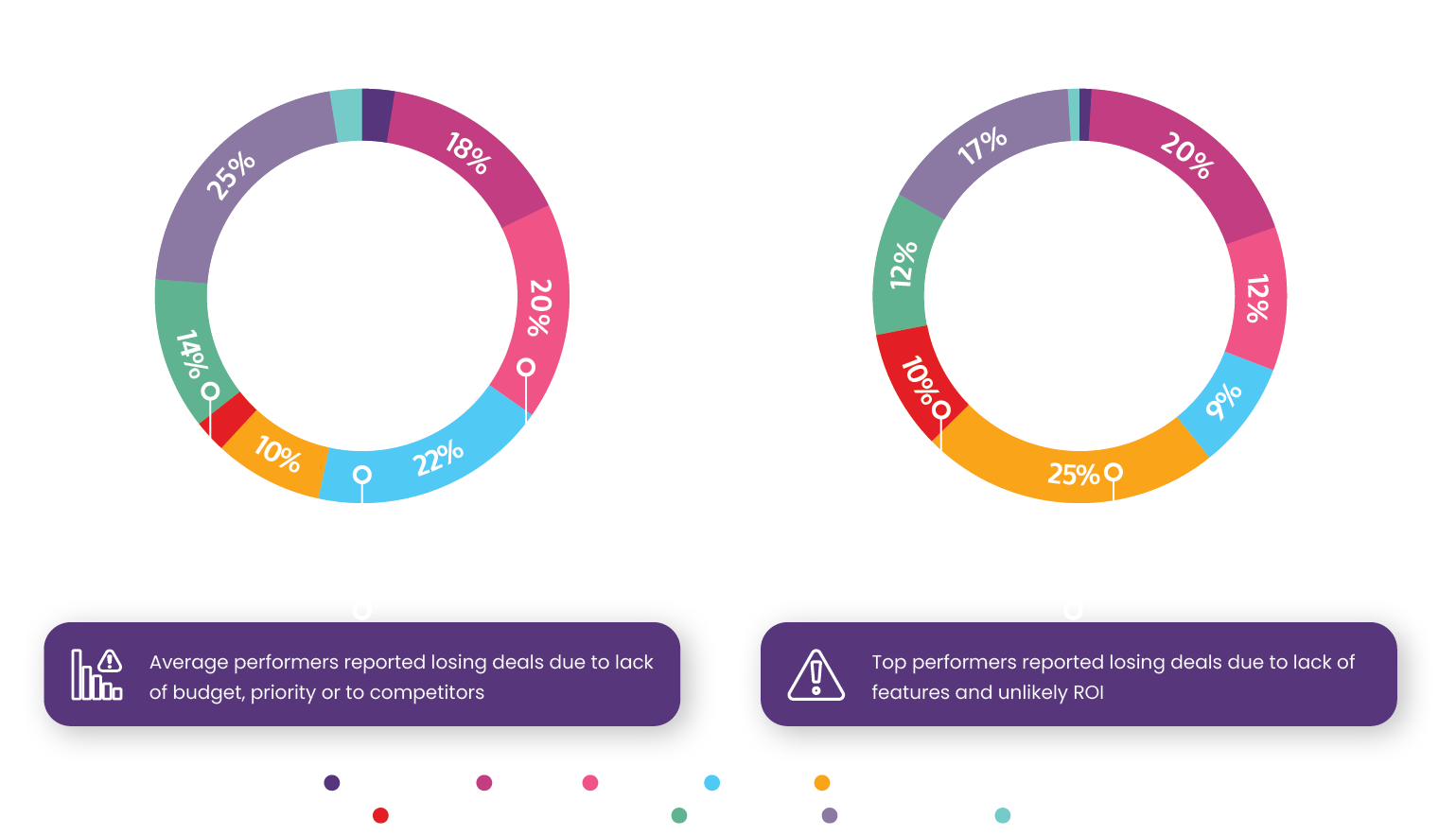

Of all deals lost, 61% were reported by reps to be lost due to ‘indecision’. Amongst average performers, the common reasons for losing deals were lack of budget (22%), not a priority (20%), or a competitor (14%).

Top performers are 364% less likely to lose a deal due to indecision. Their reasons when closing opportunities are very different, with lack of features (25%) and ROI (10%) the standouts.

To understand the accurate reasons why these deals were being lost, our analysis took us to the conversations these reps had before closing the opportunity. As we will see next, budget, priority, and competitors were the objections most likely to prevent an opportunity from progressing for average performers.

Insights:

Canceled meeting reduces stage progression by

More than 7 days of inactivity (with no future activity) reduces win rates by

Advice on improving performance

61% of deals are lost due to indecision

Want your reps to handle objections more effectively?

Ebsta helps identify the objections that reps struggle most with

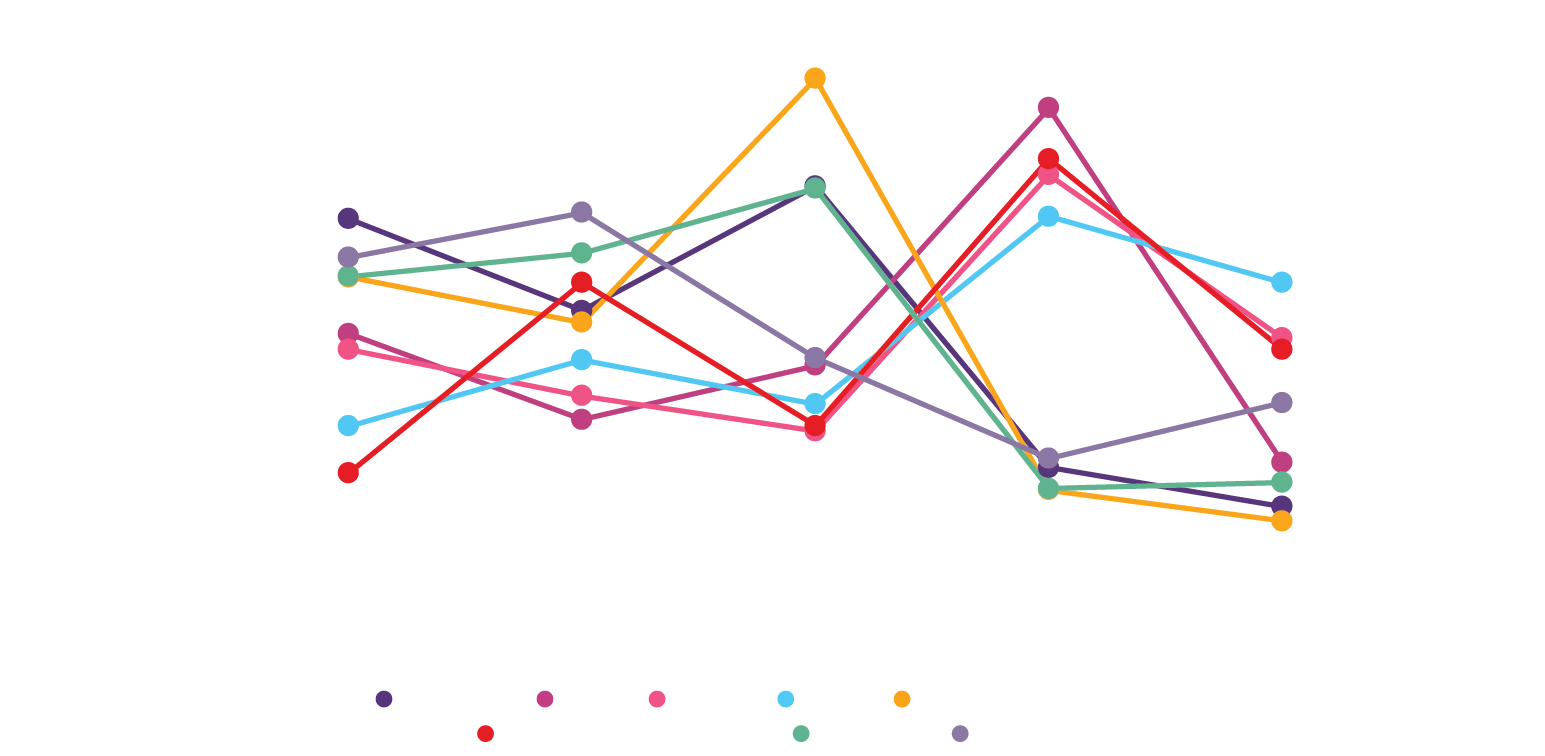

Impact of Objections on Deal Progression

As we noted in the qualification section, top performers are not only able to handle objections, but they also leverage their qualification to anticipate these objections and ensure they are equipped to overcome them.

Not only are top performers

For average performers, not only are they closing deals because of a lack of budget, priority, or a competitor, but they are also seeing many deals stall due to these objections. Contrast this to top performers, who are more successful at anticipating those objections and then building compelling business cases that address the concerns.

Objections also present opportunity. For top performers, they are able to turn concerns over ROI into accelerating deals. The timing of this is essential. When presented early, deals progress quickly. But if the ‘economic buyer’ raises ‘ROI’ after ‘solution presented’, the likelihood of closing drops by

Insights:

Top performers

Advice on improving performance

Top performers 843% more likely to overcome objections

Want your reps to handle objections more effectively?

Ebsta helps identify the objections that reps struggle most with

Relationship Management

The key to a successful negotiation relies on having the right people from the target organization aligned with the vendor. As discussed earlier, this begins with engaging the right persona at the right time.

Top performers are

This is demonstrated in the graph opposite. Successful deals involve

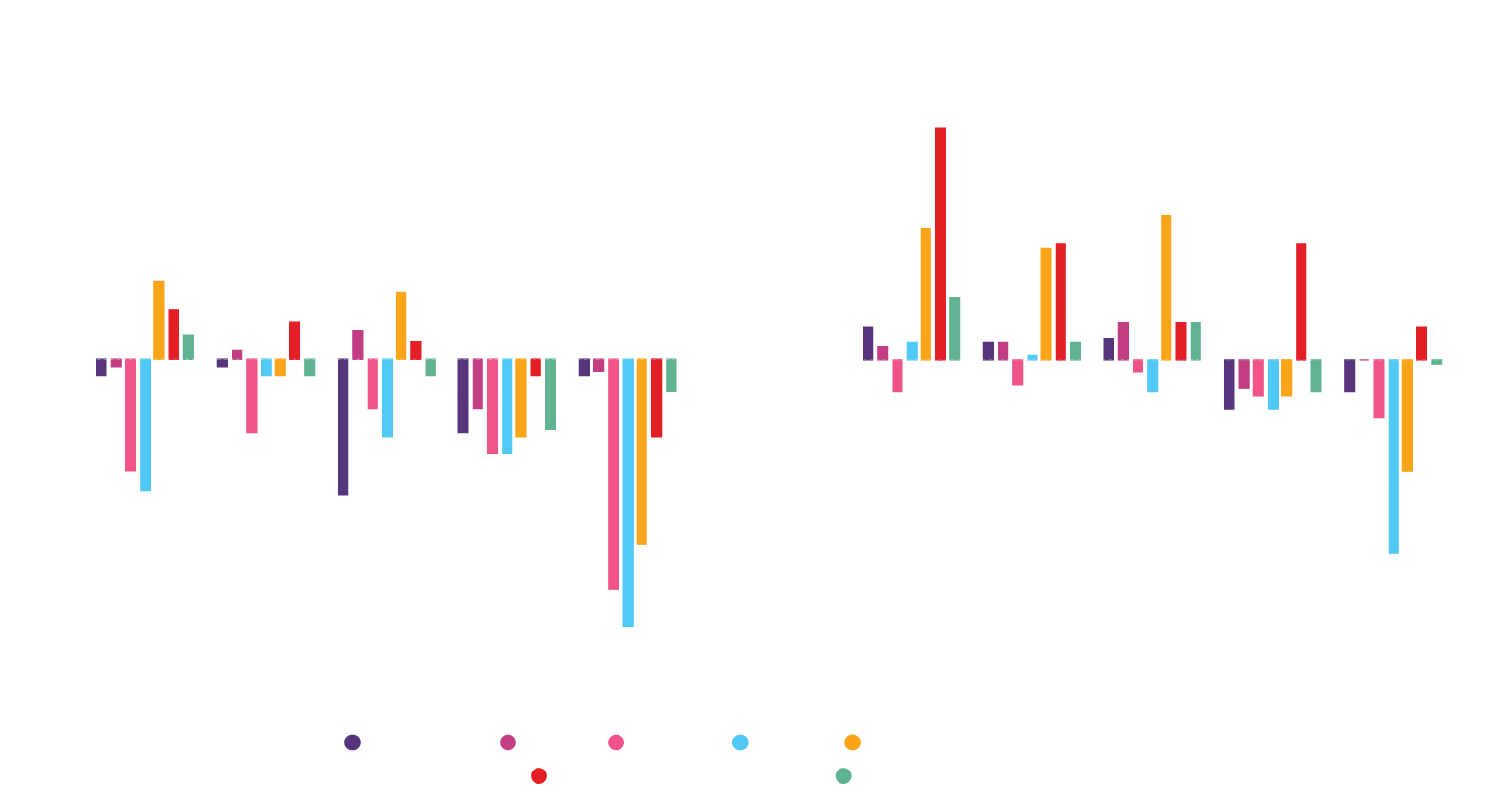

Activity can indicate how a deal is progressing; however, as shown by won and lost deals, it can easily be excessive or insufficient.

When deals are won, activity is

On the other hand, when deals are lost, there is

To excel in negotiation, top performers engage key stakeholders before the solution is presented. We can see in the flurry of activity back and forth early in the process. After a lull after the solution is presented, activity with key stakeholders then intensifies in the negotiation stage to iron out the finer details.

In contrast, unsuccessful deals often involve a similar flurry, but with few contacts. However, much of this activity is in one direction instead of being reciprocated. When it is time to present a solution, only a handful of stakeholders are engaged, as shown by activity and engaged relationship levels. As the latter stages approach, rep activity increases as the deal stalls. By this stage, the damage has already been done, and the likelihood of closing is drastically reduced.

Advice on improving performance

Top performers engage key stakeholders early in the sales process

Want to build stronger relationships through the customer lifecycle?

Ebsta helps reps to prioritize engaging the right stakeholder at the right time

Deal Management

As with the negotiation stage, there is no ‘silver bullet’ to closing more deals. What is evident when looking at top performers, however, is how proactive they are compared to their peers. They partner with buyers, guiding them to the right solution. This is in contrast to average performers, who often wait for buyers to come to them and leave them to make their own decision, often leading to indecision.

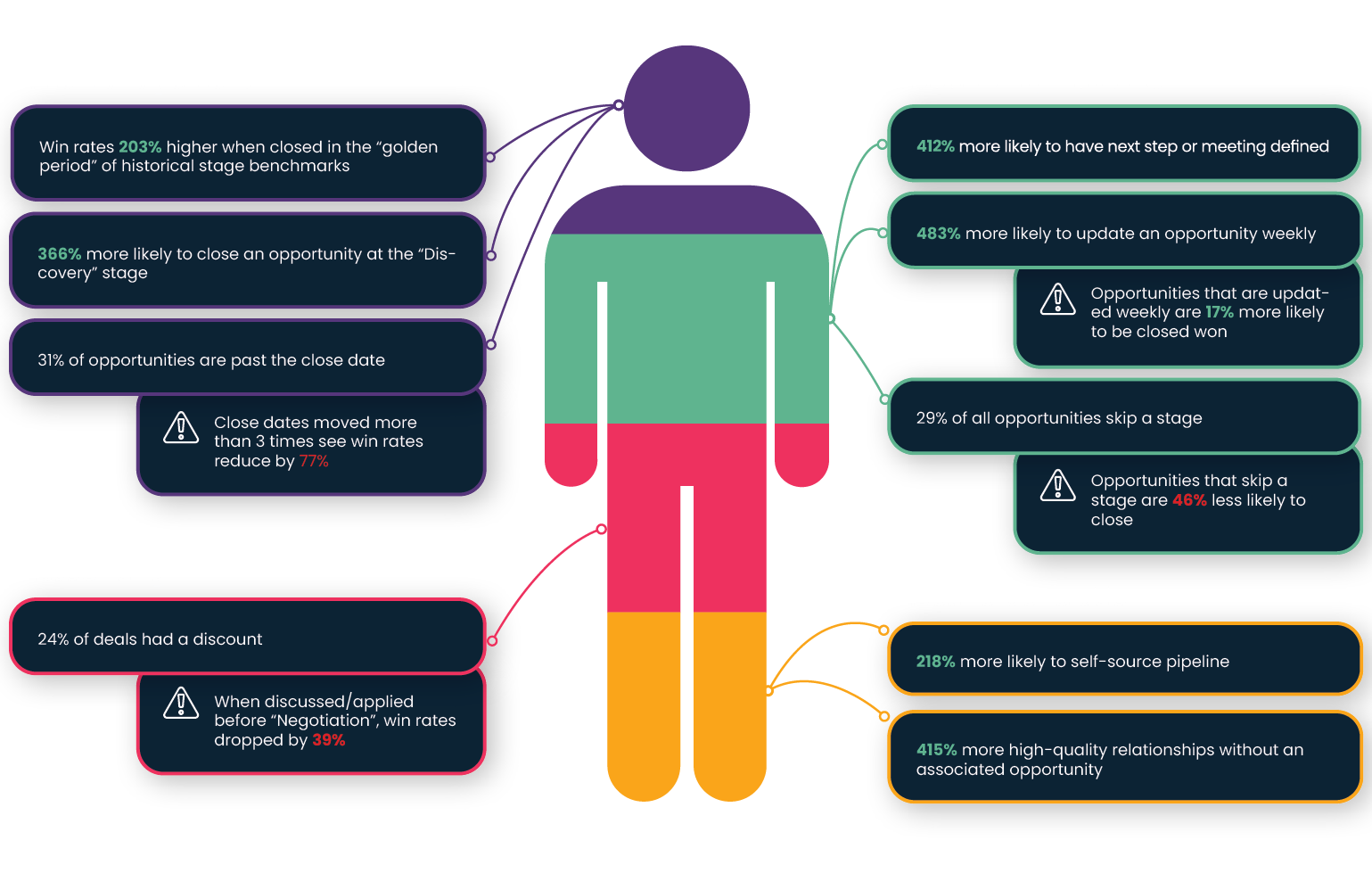

We can see how top performers are more effective at deal management through four attributes: time management, updating opportunities, discounting, and pipeline generation.

When managing opportunities, time is a resource, and how they spend that time affects how likely deals are to close or to slip. With deal slippage at a high of

When deals are in-flight, maintaining momentum, as we have covered, is key to high performance. Top performers demonstrate this with their behavior. They are more likely to define a next step and keep it up-to-date as deals progress. They are more likely to update the opportunity weekly and reflect on what is required to advance the deal. They are less likely to skip a stage and instead thoroughly execute the deal at every stage.

Top performers resist the urge to offer discounts until necessary. A trait of average performers is offering these early in an attempt to reignite or rescue opportunities. However, win rates dropped by

Lastly, top performers proactively self-source future pipeline. They not only maintain quality relationships during a sales process but also do so outside of the sales process too. Rather than forcing a solution onto a prospect when they are not ready, they nurture their relationship so that when the time is right, the prospect already has a preferred vendor in mind.

Advice on improving performance

Top performers more likely to adopt a proactive approach

Want to improve the efficiency of your reps?

Ebsta guides reps to behaviours most likely to progress deals

Conclusion

In the span of 12 months, B2B sales have become increasingly challenging. The “more equals more” approach is no longer sustainable, forcing many businesses to reduce spending on team expansion, tech stack enhancement, and marketing budgets. As a result, only those who adapt will survive.

Now, businesses must depend on a select few profitable performers. For those not meeting their quotas, many companies have little choice but to let them go. This divide is widening with the advent of AI, which top performers are adopting early to enhance their sales effectiveness.

For sales teams, this situation presents both a challenge and an opportunity. Many teams have top performers whose methods can be analyzed to uncover the drivers behind their revenue generation. The solution to poor quota attainment lies within the practices of these top performers.

Those who succeed in this market will be those who use data to identify what drives their success. They will know which accounts to focus on and the optimal timing. They will understand which personas to engage with and the best time to involve them in the sales process. They will qualify deals effectively, use insights to anticipate objections and maintain a high-quality pipeline. They will prioritize building quality relationships early on with senior personas. By proactively managing opportunities, they will partner with buyers to address their problems—or remove them from the pipeline if no partnership is possible. They will develop the systems and processes that yield repeatable results across the team.

Within an organization’s data lies proven factors driving success. Those who leverage that data to make more effective decisions will thrive. Those who do not will be left behind. In 2024, sales teams not only need to be more efficient - they need to be more effective.

Jacco van der Kooij,

Jacco van der Kooij,  Laura “LG” Guerra,

Laura “LG” Guerra,

Elizabeth McCalley,

Elizabeth McCalley,