Is It Wise to Ignore ‘Strategic Value’ Deals Because of Low Probability?

Even the most sophisticated forecasting frameworks often struggle when assessing ‘long-shot’ opportunities; those deals with low win probabilities but potentially high strategic value if they are successful.

Traditional forecasting typically relies on stage-based probability weighting, where each sales stage is assigned a predetermined probability (e.g., 20% for Discovery, 50% for Proposal Sent, and 80% for Contracting).

The forecasted revenue is then calculated by multiplying the deal value by the stage’s assigned probability. While this method provides a broad-brush view of pipeline health, it can underrepresent the strategic importance of specific opportunities or overstate the feasibility of others.

For example, a deal in the ‘Negotiation’ stage might carry a default 70% probability. However, if the champion unexpectedly leaves the buyer’s organization, that probability may be artificially inflated. Likewise, a high-value, low-stage deal may receive virtually no credit in a classic forecast despite being a strategic target worth investing resources to nurture.

The Case for a Complementary Metric

RevOps teams that rely solely on stage-weighted forecasts often overlook key strategic dimensions: the strength of stakeholder relationships, deal complexity, and alignment with core business objectives.

With an estimated 35% of revenue leaders still relying on spreadsheets for forecasting, there’s a clear need to inject more nuance into the process, particularly for deals that fall outside the “safe bets.”

Modern RevOps frameworks already advocate multivariable forecasting, taking into account market trends, customer behavior, and economic indicators. Yet even these more advanced models rarely incorporate a systematic way to quantify the “effort versus impact” calculus for high-value, low-probability opportunities.

Without a targeted metric to capture that calculus, CROs risk misallocating resources, either diverting too much effort to lower-value “sure things” or neglecting strategic “long shots” that could yield significant upside.

Introducing the Opportunity Win Leverage (OWL) Metric

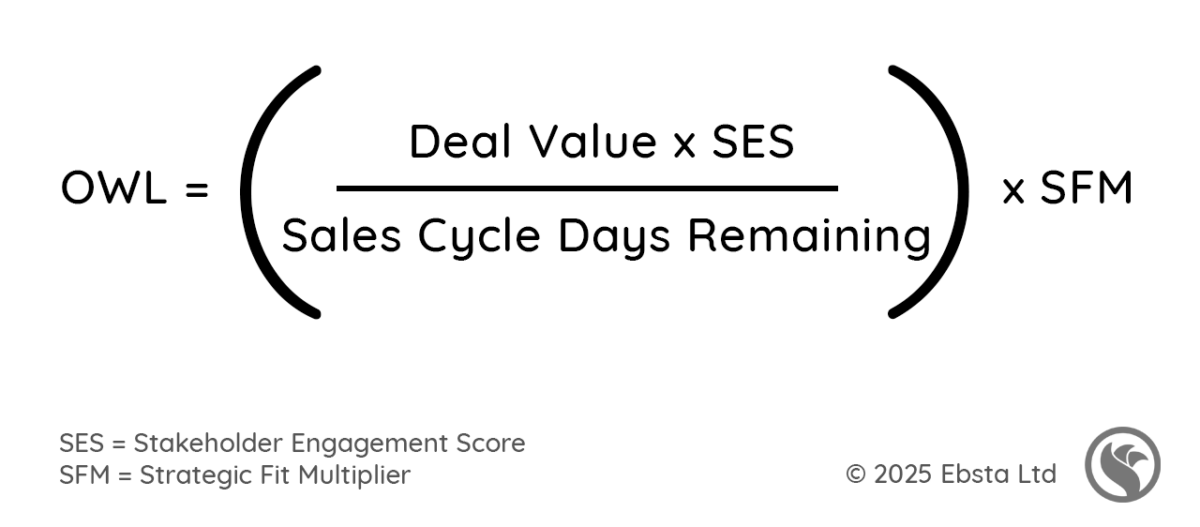

The Opportunity Win Leverage (OWL) metric has been explicitly designed to address this strategic gap. OWL evaluates the amount of influence or effort required to move a low-probability deal into a likely win by combining four key dimensions: deal value, stakeholder engagement, sales cycle timing, and strategic fit.

Unlike traditional stage-based approaches that treat all deals in “Proposal Sent” or “Negotiation” as homogenous, OWL differentiates based on how well the sales organization knows the decision-makers, the remaining runway to close, and whether the opportunity dovetails with long-term corporate goals (e.g., entering a new vertical or winning a marquee account).

By quantifying these factors into a single score, CROs and RevOps managers gain an at-a-glance indicator of which “tougher” deals are worth executive focus and which might be deprioritized.

In practice, integrating OWL alongside existing forecasting models helps leadership allocate resources, such as executive sponsorship, marketing development funds, or technical support, in a manner that maximizes return on sales effort.

OWL Formula and Its Components

At its core, OWL is calculated as follows:

Deal Value

The expected revenue if the opportunity closes. This should include any upsell or add-ons that are reasonably forecastable at this stage.

Stakeholder Engagement Score (1–10)

A weighted measure of how well your team connects with the buyer’s key decision-makers. This score might factor in:

- Number of meetings with the executive sponsor or champion.

- Level of positive sentiment expressed by the buyer’s committee during calls or demos.

- Depth of references or proof-of-concept involvement.

A higher score indicates stronger relationships and greater potential for influence. This type of scoring is automatically calculated in Ebsta’s platform.

Sales Cycle Days Remaining

The number of days left until the forecasted close date. By dividing by the number of days remaining, the metric rewards deals with sufficient runway to apply influence while penalizing those on the brink of stalling.

Strategic Fit Multiplier (1.0–2.0)

Reflects how closely the opportunity aligns with Ideal Customer Profile (ICP), vertical priorities, or critical business objectives (e.g., landing a flagship customer in a new region).

- 1.0 = Baseline fit (good, but not transformational)

- 1.5 = Strong fit (aligned with a major segment or expansion goal)

- 2.0 = Highest value (lighthouse account, adjacent market entry, or critical cross-sell/up-sell)

For example, consider a $100,000 deal in “Proposal Sent” with a stakeholder engagement score of 8, 20 days remaining, and strategic fit of 1.5:

Multiply Deal Value by Engagement Score:

100,000×8=800,000

Divide by Days Remaining:

800,000÷20=40,000

Multiply by Strategic Fit:

40,000×1.5=60,000

Thus, the OWL Score for this example is 60,000. That’s a high score. It indicates that, strategically, this opportunity is worth focused effort.

Benefits for CROs and RevOps Managers

Improved Resource Allocation: By highlighting which low-probability deals require executive alignment or specialized resources (e.g., C-suite sponsorship, custom technical workshops), OWL prevents “herding” where all efforts focus on the same mid-tier deals.

Enhanced Deal Coaching: Sales leaders can use OWL as a conversation starter. Instead of asking, “Why is this stuck?” they can ask, “How can we improve engagement or accelerate the timeline to boost this OWL score?”

Strategic Alignment: OWL helps quantify strategic fit. If your company aims to break into the financial services vertical, any deal with a high strategic fit multiplier in that segment will surface higher OWL scores.

Data-Driven Prioritization: OWL integrates easily into CRM dashboards or pipeline review decks, enabling RevOps to build scorecards that rank all open deals by OWL. This makes pipeline reviews more actionable, focusing on high-leverage opportunities.

Summary of Strategic Value Deals

In an era where every percentage point of forecast accuracy can translate to millions in revenue, CROs and RevOps managers need tools that go beyond one-size-fits-all stage weighting.

The Opportunity Win Leverage (OWL) metric offers a structured approach to identifying high-impact, low-probability deals that are often obscured by the noise of traditional pipeline reports.

By combining deal value, stakeholder engagement, remaining sales cycle, and strategic fit into a single score, OWL empowers revenue leaders to focus resources where they matter most.

Championing deals that could become game changers for the business. Implementing OWL in your CRM ensures this strategic lens is embedded in your sales process.

Ultimately, OWL doesn’t replace classic forecasting; it complements it, helping revenue teams allocate effort, coach reps, and align execution with long-term objectives. Embrace OWL to give your pipeline reviews the clarity and strategic precision they deserve.

Table of Contents

Share this article

Sign up for Insights

Learn from the brightest minds how to predictably and efficiently grow revenue.

Related Content

Why 52% of New Revenue Now Comes From Existing Customers

In this episode of Revenue Insights, host Guy Rubin sits down with Ben O’Mathuin, Principal Consultant at Customer Lift, to explore how companies can transform Customer Success (CS) from a retention function into a strategic revenue driver. Discover why traditional QBRs are becoming obsolete, how to create meaningful C-suite engagement, and the practical frameworks for…

The Essential Sales Tech Stack for Startups (Without the Bloat)

A sales tech stack is the collection of tools your sales team uses every day to generate pipeline, connect with prospects, and close deals.

Ebsta and Fullcast: Better Together

In 2021, Gartner research predicted that 75 percent of companies would be using a RevOps model by the end of 2025. Revenue operations is arguably the most talked-about topic in recent months. However, it still feels like the revenue engine powering most go-to-market teams today is running on fumes, and no one’s admitting it. Misaligned…