Table of Contents

Share this article

Learn from the brightest minds how to predictably and efficiently grow revenue.

Related Content

B2B Sales Benchmarks: 2023 H1 Update

The latest update from the 2023 B2B Sales Benchmarks analysis of over $37bn in pipeline.

How to improve AE quota attainment (according to data)

23% of reps are contributing 83% of revenue. Here's how to solve it (with data)

How to Run Pipeline Reviews (according to high-performing sales teams)

Pipeline reviews, love them, or hate them, are a vital fixture in a salesperson’s week. Done well, they are an opportunity for guidance, reflection, and improvement. Done poorly, they waste time, create frustration, and can leave reps feeling alienated. Pipeline reviews tread a fine line between helping a rep to make quota or creating friction…

How to close more target accounts with deal qualification

Sales methodologies guide sellers on how to engage prospects at various sales stages. At the very first stage, qualification methodologies (such as Challenger, BANT, MEDDPICC®, etc.) have long been established to create structure and process when opportunities enter the pipeline. Ultimately, the goal is to create consistency at different stages, ensuring sellers follow best practices to increase the effectiveness of their activity.

Which is best, well, that’s up for debate. However, what is clear is that using a sales methodology such as MEDDPICC® consistently increases win rates by up to 311% (according to the 2023 B2B Sales Benchmarks Report). From the analysis of $37bn of sales pipeline, high-performing reps were 437% more likely to complete the qualification criteria.

Therefore, it’s less a question of which methodology to use. A better question is, how do you effectively use a deal qualification methodology to close more target accounts?

Table of Contents

1. Identify your highest velocity ICP

Efficiency in closing target accounts relies upon a solid foundation. The most effective way of closing more accounts begins with prioritizing the correct accounts. To understand which these are – we can turn to historical performance to establish the profile of the accounts which close fastest.

While not part of the deal qualification process – it’s a critical pre-cursor. Identifying which accounts close fastest instills a clear understanding throughout sales of the type of account to prioritize. Then, when qualifying deals into their pipeline, they have a clear outlook of which opportunities are most likely to close successfully.

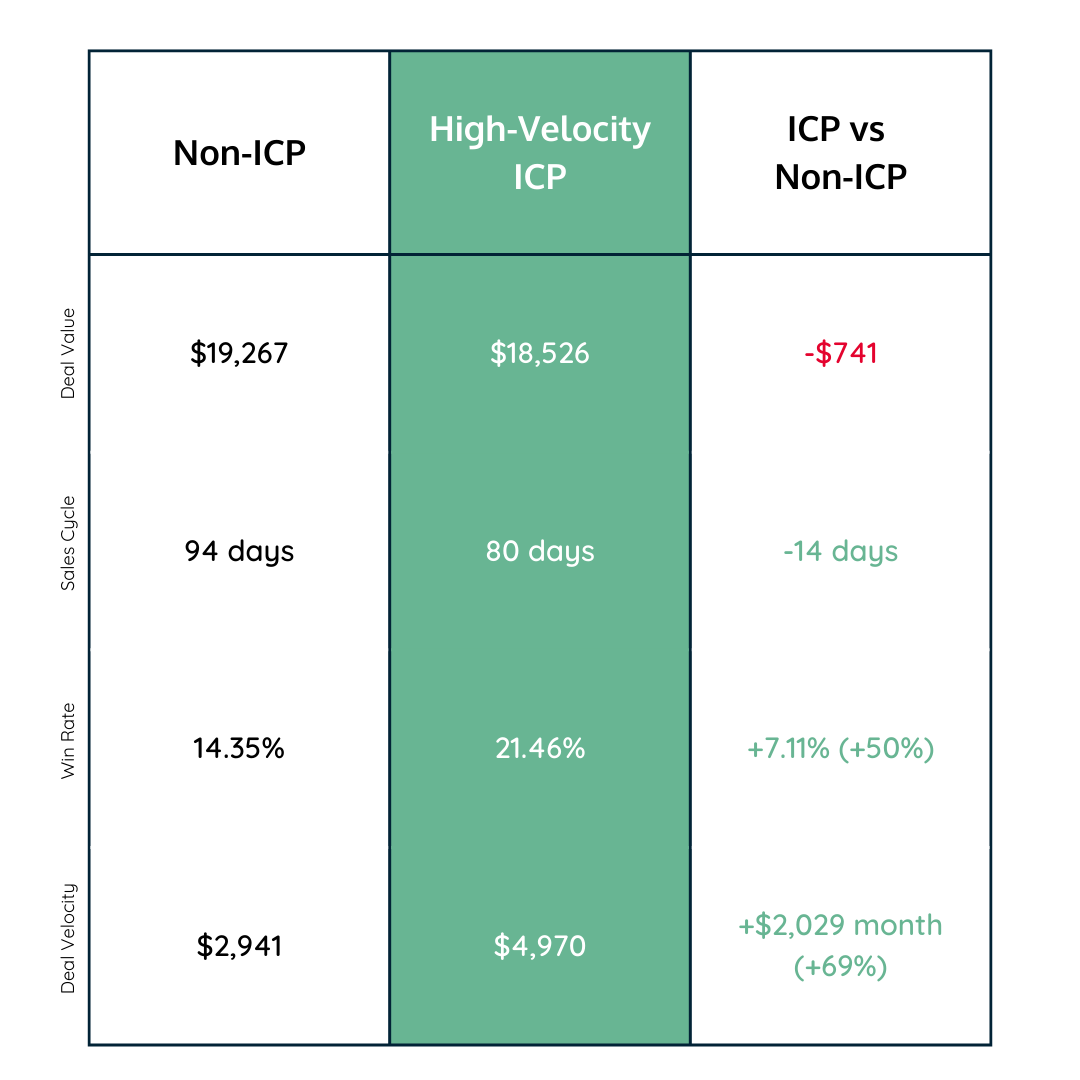

To reveal the highest velocity ICP, we must first analyze closed won pipeline. We can look at this simply through the lens of deal velocity. For example, where do we see the largest deal values, highest win rates, and shortest sales cycles?

From here, we can segment those deals in several different ways to reveal which has the highest velocity. The region, industry, company size, and technography are all filters to consider.

This analysis sets a precedent for the profile of deals to prioritize when qualifying them into pipeline. It’s not always the largest deals that are best – instead, consider how quickly they move through the pipeline and how likely they are to close too.

2. Adopt a deal qualification sales methodology

The key to efficient revenue growth lies in predictable, scalable processes. In 2022, the number of businesses adopting a sales methodology doubled. Our analysis of the $37bn in sales pipeline shows that MEDDPICC is the most popular.

That being said, what matters most is not the methodology you choose – but the adoption of it.

Deal qualification methodologies provide a structure for determining whether a lead or prospect fits your product well. In addition, they enable businesses to determine key criteria when creating opportunities.

At a high level, we’ve already covered the impact adoption of a sales methodology has on win rates – and high-performing reps are 437% more likely to complete the qualification criteria.

Qualification methodologies should be more than just a checklist or more admin for sellers. They set a standard for deals as they enter the pipeline. It’s not good enough for sellers to accept opportunities to provide pipeline coverage and show that everything is on track. Instead, qualification methodologies set a premise for only taking deals with a clear route to close.

A seller’s time is as valuable as the buyer’s. The quality of pipeline is far more valuable than the quantity. Sellers must focus on the deals most likely to close successfully to improve efficiency. Achieving this requires understanding the profile of those deals and ensuring the deals they accept into their pipeline meet the criteria for success.

3. Multi-Thread Accounts

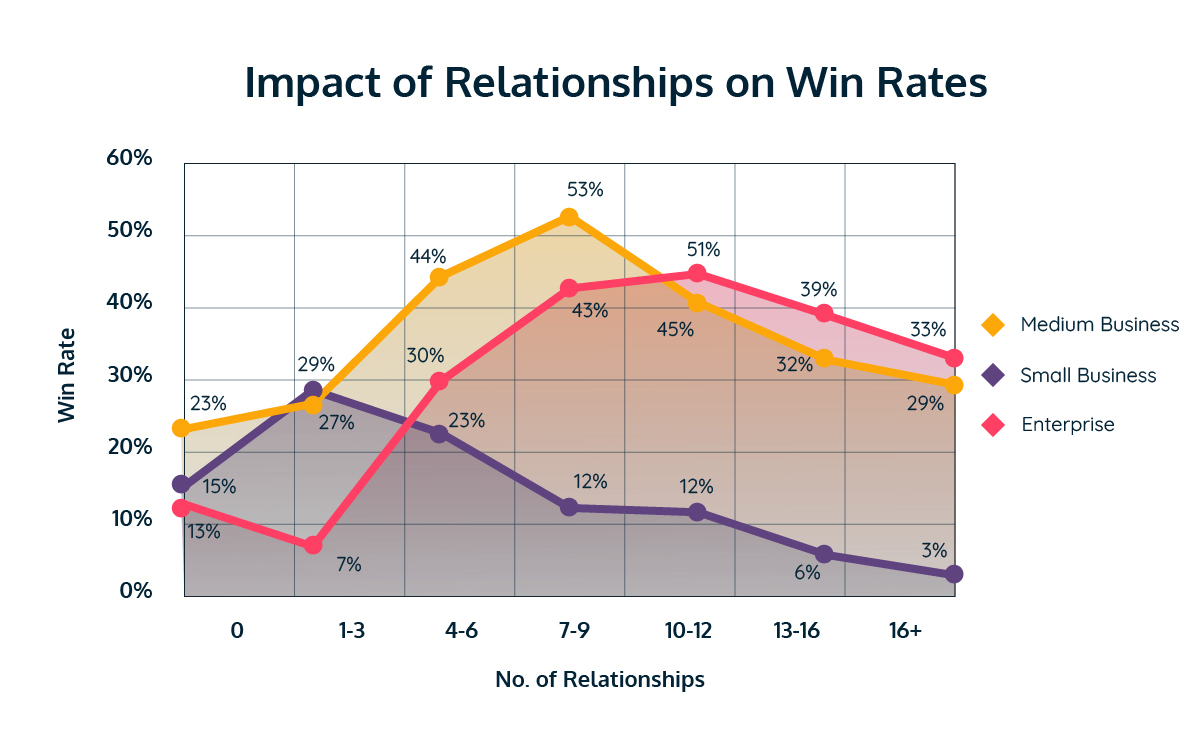

Some qualification methodologies, such as MEDDPICC and BANT factor decision-makers into the qualification process. Others, such as Challenger and STRONGMAN, forego it. Whichever deal qualification you use, a critical component is ensuring you build multiple relationships into a target account.

Progress within an account can quickly stall if a single contact moves on loses their budget, or ultimately lacks the buying power.

Building multiple relationships is more important than ever. According to Gartner, the typical B2B buying decision in 2023 includes 6-10 decision-makers. Despite this, most sellers are nurturing relationships with less than six contacts.

The impact of when they do, however, is substantial.

With 7-9 relationships (versus 4-6), enterprise deals averaged 42% win rates. Meanwhile, medium-sized deals had 39% higher win rates than only 4-6.

This knowledge alone is often not enough. Sales methodologies (such as deal qualification) effectively establish consistency and identify who to build relationships with. They ensure sellers are unearthing who the key decision makers are early in the process. As the opportunity progresses, what becomes important is designing sales plays to engage those individuals.

For example, have they connected with those individuals on LinkedIn? Have they been invited to demo meetings? Can your primary contact or champion introduce you to them?

4. Leverage qualification criteria through the sales process

Of businesses that use a deal qualification methodology, only 15% of deals are fully qualified. Yet as mentioned, win rates are 311% higher when sellers utilize them.

The question then becomes, how do you increase the adoption of a deal qualification methodology?

The answer lies in the meetings that sellers consistently have. Pipeline reviews, forecast calls, prep calls, and even debriefs.

Sellers should not forget the insights from the decision criteria, process, and who the key decision makers are by the time an opportunity reaches the evaluation stage. Instead, these insights should be readily available for pipeline reviews, etc.

There are two ways of keeping these front of mind. First is creating an agenda for those meetings to provide a format for sellers to focus on the key issues at hand. The second is integrating the deal qualification methodology into your CRM so this vital information is not tucked away in a spreadsheet.

With this, visibility on why reps qualified deals becomes as valuable (if not more so) than having visibility on activity with a target account. As discussed, the value in deal qualification is not only setting the standard for opportunities entering the pipeline. It is also to define a clear blueprint for how that deal will close.

For example, understanding who the decision-makers are becomes valuable in prep calls. Not only because sellers have insight into who they are speaking to – but also to identify who they need to build relationships with (that stakeholders on the call could make an intro to). In addition, understanding the deadline or decision process is valuable during pipeline reviews to ensure target opportunities are on track.

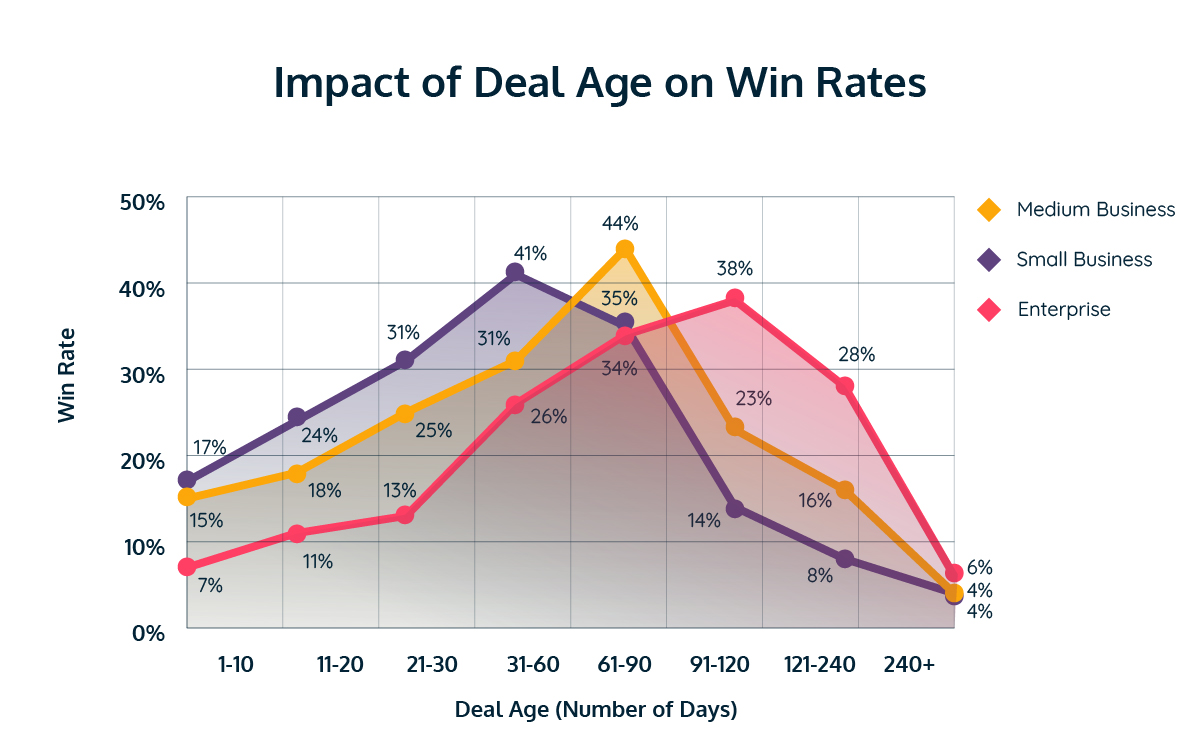

5. Cut loose target accounts that run too long

There are no guarantees in sales. Even with perfect execution and alignment with a prospect, it’s still not certain they will sign. Hope and gut feeling commonly shroud good judgement when reviewing target accounts in pipeline. In fact, our analysis shows 37% of deals slipped by the end of 2022.

So to close more target accounts, sellers need more support with which target accounts to prioritize. One way of doing this is by leveraging initial qualification on deadlines or the decision process to understand when the buyer wants or needs to decide.

In addition, revenue teams can also analyze the average time similar deals spend in stage – as well as the average length of the sales cycle overall. Sales teams are then equipped with a secondary gauge of how smoothly deals progress through their pipeline.

For example, let’s say deals typically close in 90 days. When it is next time for a pipeline review, one deal has been in pipeline for 104 days – and the buyer stated they needed to choose in 3 months. Despite the seller’s good intentions that it just needs the sign-off of the final decision maker – we know that this deal is running far longer than usual. Sunk cost fallacy comes into play here, and it’s hard to let go when a deal has come so close and plenty of work has gone to bring it this far.

However, according to our analysis, deals that run one month longer than the average are 60% less likely to close. Make it two months longer than average; the chances are almost nil.

Every deal is ultimately unique; however, this is where a manager’s experience, guided by insight, can identify lost causes and help sellers to prioritize the right accounts.

How to close more target accounts with deal qualification this year:

- Select (or design) a deal qualification methodology that matches your sales process

- Identify your highest-velocity ICP

- Kick off the methodology and demonstrate how the process will support sellers in closing more

- Create a consistent meeting cadence to leverage the qualification criteria throughout the sales process

- Multi-thread target accounts with key decision makers

- Integrate your deal qualification methodology inside your CRM

- Cut loose deals that run longer than the close date or average time it typically takes to close