Table of Contents

Share this article

Learn from the brightest minds how to predictably and efficiently grow revenue.

Related Content

Tackling Sales Team Churn: Why Sellers Leave and How to Fix It

Business Development Representatives (BDRs), Sales Development Representatives (SDRs), and Account Executives (AEs) often leave their roles within 18 months, costing companies significant resources in recruitment, training, and lost revenue opportunities. Understanding sales team churn, the impact of churn on revenue growth, and actionable strategies to address these issues is critical for Chief Revenue Officers (CROs)….

Lessons in Scaling Cybersecurity Sales with Dean Hickman-Smith

This week on the Revenue Insights Podcast, Guy Rubin, CEO of Ebsta, speaks with Dean Hickman-Smith, Chief Revenue Officer at HackerOne on Scaling Cybersecurity Sales. In this episode, Guy and Dean explore the evolution of sales leadership, the power of community in B2B sales, and how AI is transforming sales enablement and performance. Dean Hickman-Smith…

Building High-Converting Teams with Sean Murray of LeadIQ

This week on the Revenue Insights Podcast, Graham Smith speaks with Sean Murray, Senior Director of Sales and Sales Development at LeadIQ. In this episode, Sean shares his journey to tech sales, discusses his approach to building high-performing SDR teams, and explains why quality outreach trumps quantity in today’s sales landscape Sean Murray is Senior…

How to improve AE quota attainment (according to data)

By the end of H1 2023, 27% of reps made quota. That’s 2% less than at the end of 2022. Market conditions have improved at the halfway mark of the year (win rates +7%, sales cycles -18% vs. end of 2022) – yet rep quota attainment continues to falter. It’s a scenario many sales teams are sadly all too familiar with. At the time of writing, 23% of reps are responsible for contributing more than 83% of revenue.

In this scenario, the common response is to swiftly replace those struggling. High-churn of sellers has been a familiar sight in recent years. Under-performers are shuffled out of the business whilst a conveyer belt of new joiners replaces them, all with the hope of finding someone who can consistently hit their target. When they don’t, the cycle repeats.

In previous years, when business was booming, and the ‘growth-at-all-costs’ playbook flew off the shelves, the high churn approach served a purpose. But now, we operate in a time when budgets have been cut (with 65% fewer new AEs joiners), and sales teams are 22% smaller on average – yet the revenue goal remains the same.

Why it’s important to focus on revenue efficiency with Eddie Reynolds, Union Square Consulting:

As such, with greater demands being made on sales teams, the high-churn approach is no longer sustainable. Whilst the prospect of turning every seller into a rockstar is optimistic at best – there has to be a better way to improve rep performance consistently. Otherwise, we remain in a constant state of instability where the revolving door policy means there is no solid foundation for efficient, sustainable growth.

Fortunately, there is a better way.

Table of Contents

Learning from the behavior of high-performers

The key to improving quota attainment is to learn from what is already working. Within the behavior of every seller lies the leading indicators of success. It’s table-stakes these days to measure lagging indicators such as revenue, win rates, and sales cycles – but leading indicators (i.e. inputs) are often overlooked.

To understand what high-performers are doing well, we can take two approaches. First, we can approach this qualitatively: reviewing calls, inspecting e-mails, and speaking with the rep themselves. The challenge here is that it’s nigh-impossible to determine cause and effect (however, we’ll come back to how it can be helpful later).

The alternative is to look at their performance quantitatively. To begin with, we can look at the common leading indicators of activity, connection rate, and meetings booked – however, these are not scalable or efficient. For example, greater activity does tend to yield better results to a point – but quickly devolves into rep burnout and frustrated (or worse) prospects.

Therefore, we must go deeper. It’s not just a question of how much activity – it’s who the activity is with. It’s not just connection rate; it’s e-mail replies, meetings delivered, calls held, and who was engaged on those calls.

Using the common analogy of the iceberg, we must look beyond the surface metrics to understand the behavior of high-performers. Instead, when we peer beneath the surface, the secret lies in the factors contributing to those surface metrics.

In our most recent analysis – these are the common leading indicators of high-performing sellers:

- 804% more high-quality relationships

- 380% more likely to have high-quality relationships in the sales process

- 209% more likely to be using a sales methodology

- 126% more likely to have a next step or meeting defined

- 81% more likely to update an opportunity weekly

- 72% more likely to have greater than 30% of pipeline representing the best-performing ICP

- 437% more likely to complete deal qualification criteria

The answer to improving quota attainment is not how we turn every seller into a superstar. Instead, it’s how we play to the strengths of our sellers and better manage their weaknesses.

Some sellers are well-versed relationship builders and suit outbound selling into target accounts. Others are wonderful communicators and are better suited to nurturing inbound leads.

Many sellers hate the necessary admin that comes with the role – whilst others are highly organized and thrive on a proactive approach.

Regardless of whether a seller is a high or low performer, we can help them all to improve by understanding the leading indicators of their success – and then designing strategies and processes that align with these strengths.

Proven ways to improve win rates

Those leading indicators will ultimately be unique to your team; hence running the analysis yourself (or it’s something we can help with) will be critical in improving your own quota attainment.

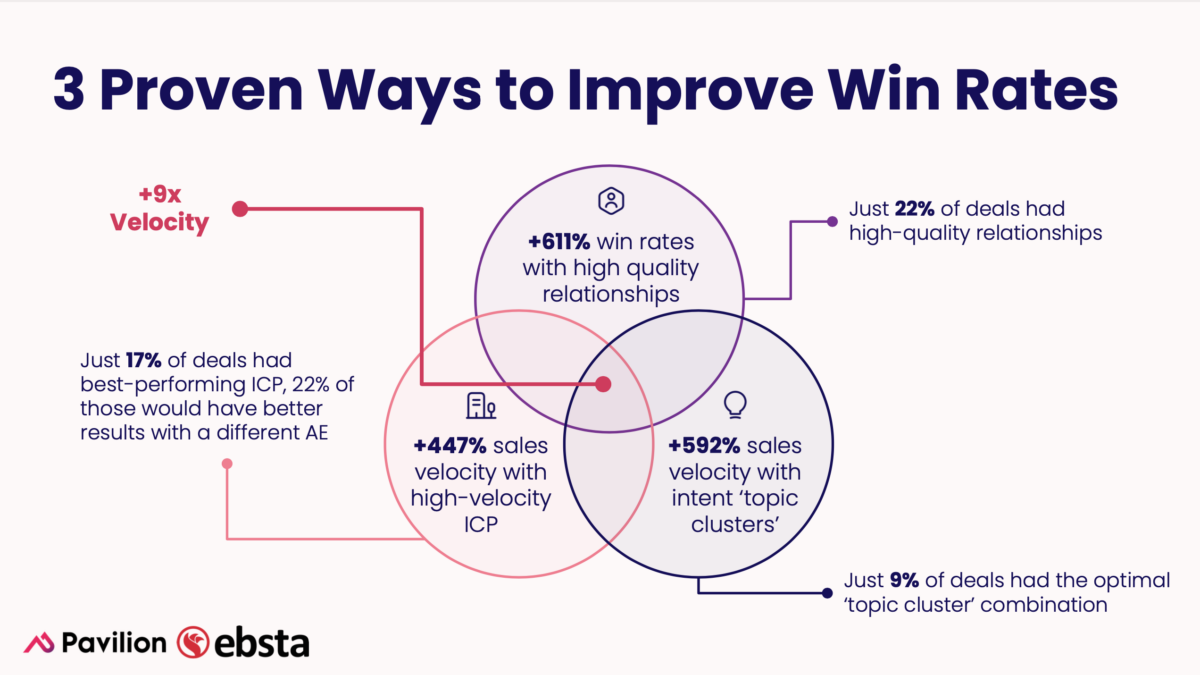

However, that being said, after analyzing $37bn of pipeline, there are 3 common areas where high-performers are finding the most success:

High-quality relationships

In an age of automation, the art of the relationship is increasingly being forgotten. There are more stakeholders involved in the buying process than ever before – and yet sellers are still only nurturing relationships with a minority slice of the buying committee.

When sellers are driven to increase activity – the strength of the relationship suffers. Yet when a deal has high-quality relationships associated with them – win rates improve by 611%. The impact is unlikely to cause even a raised eyebrow. However, just 22% of all deals (based on 3 million+ analyzed) had high-quality relationships.

While it may be unrealistic to expect every deal to have high-quality relationships being nurtured – even a marginal improvement is proven to deliver tangible improvement for sellers.

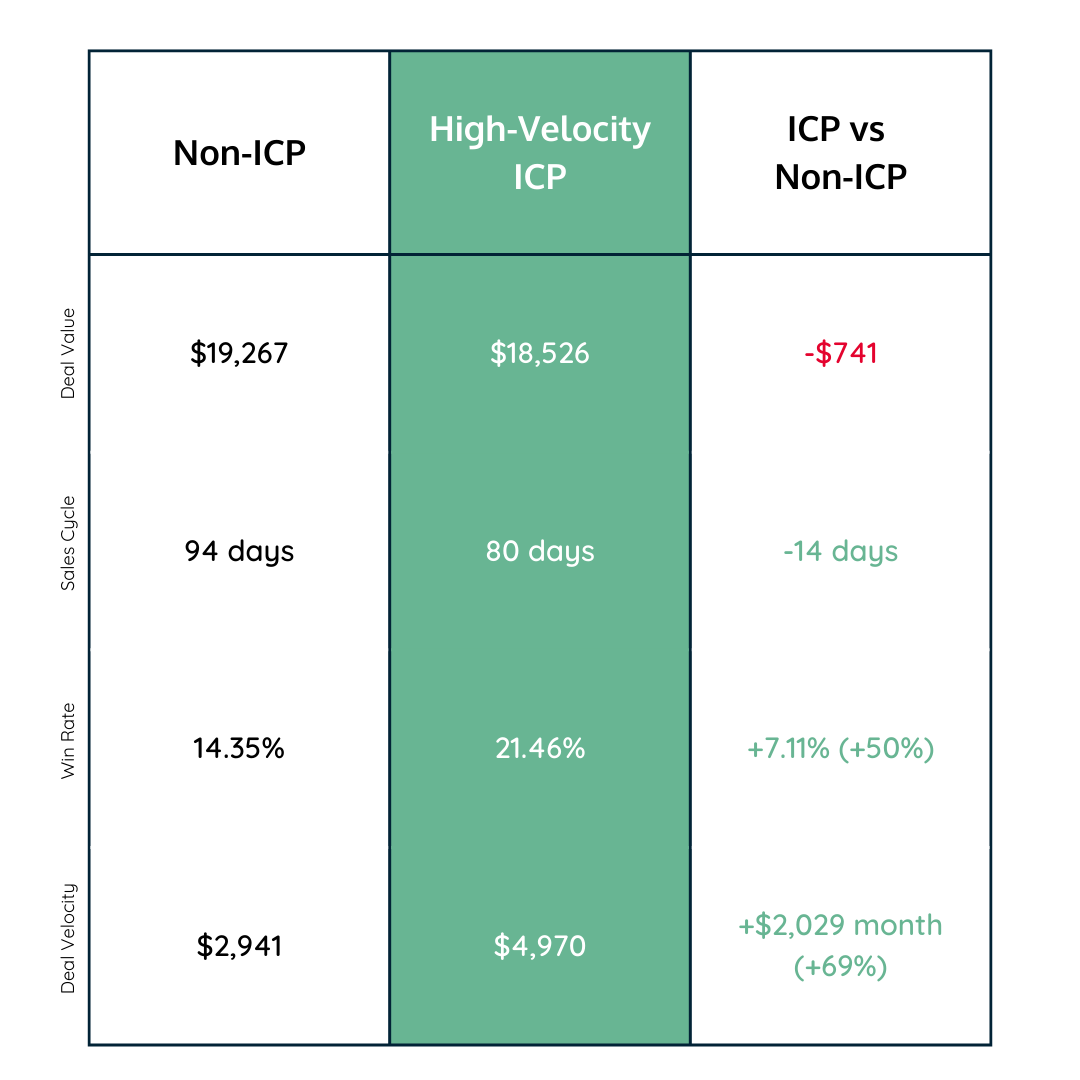

Target high-velocity ICP

We’ll all be familiar with the purpose of an ideal customer profile (ICP) by now. It’s well-trodden ground that identifying our target market helps to narrow down the potential audience size and focus sellers’ attention on accounts they can feasibly sell to.

The ICP is useful for improving outbound efforts; however, it can only focus those efforts down so far.

For greater gains, we can further filter ICP by the segments showing the highest velocity of sales.

High-velocity ICP refers to the criteria of accounts that are delivering the greatest deal velocity. This can be analyzed at a business, team, or rep level. In short, it allows us to filter the ICP further to understand the criteria that our sellers are generating the greatest return from.

When sellers are working opportunities within their best-performing ICP, their deal velocity is, on average, 447% greater than other deals.

The benefit of doing this down to the rep level is that some sellers are more effective at selling to certain accounts than others. The approach of one seller will likely be more effective at closing enterprise accounts, whilst the approach of another means they are more effective at closing small to medium businesses.

When it comes to assigning SQLs, we want our best reps to be working on the opportunities that are best suited to them based on their historical performance.

Currently, however, just 17% of deals are being matched correctly to the best-performing seller.

Why it’s important to target accounts delivering the greatest velocity with Brad McGinity, CRO of Hone:

Prioritize by intent

Intent provides a great layer of data to help narrow that target audience down to those currently in-market; the challenge is proving its effectiveness.

According to our analysis, deals with the optimal topic cluster combination delivered 592% greater deal velocity.

While intent data is far from a silver bullet, it is an effective tool in the arsenal of sales teams to prioritize the deals most likely to close.

Evidently, right now, that is not happening, with only 9% of deals having the optimal topic cluster combination.

For underperforming reps, there is no silver bullet either to resolve those issues. However, focusing their activity on the right accounts (both by ICP and intent) is proven to have a beneficial impact on their performance.

Creating consistency with process

Insights such as the above is useful for pinpointing what to do. However, they’re incapable of telling us how to do it.

This is where the sales process comes in. How to build that process is well covered elsewhere; what is important is shaping that process and any methodology that goes with it to what you are already having success with.

This is where the leading indicators of your success become especially effective. If win rates are higher when deal qualification is filled out, then introduce a process to ensure deals only progress when it has done so.

If high-quality relationships are leading to greater deal velocities, then introduce criteria to ensure a minimum number of stakeholders are engaged to progress an opportunity.

We can either trust our sellers to leverage insights on their own – or we can utilize processes to ensure they are being utilized, thereby increasing the odds of success.

5 steps to start improving AE quota attainment today:

- Analyze closed won deals to identify the common leading indicators driving revenue

- Focus sellers on prioritizing effective multi-threading

- Define high-velocity ICP criteria and allocate the right opportunities to the right reps

- Introduce intent as an additional layer to prioritize opportunities that are in-market

- Shape sales process/methodology to ensure consistent execution on your leading indicators of revenue