Table of Contents

Share this article

Learn from the brightest minds how to predictably and efficiently grow revenue.

Related Content

5 Ways to Use the Ebsta Integration With HubSpot to Improve Sales Performance

How to improve adoption of HubSpot with Ebsta

B2B Sales Benchmarks: 2023 H1 Update

The latest update from the 2023 B2B Sales Benchmarks analysis of over $37bn in pipeline.

How to improve AE quota attainment (according to data)

23% of reps are contributing 83% of revenue. Here's how to solve it (with data)

How to Analyze Your Sales Pipeline – Optimize Your Pipeline for Growth

Ultimately, the key aspect of analyzing your pipeline is to understand enough about it to be able to make smart decisions and actualize growth. By building up data-based insights into your pipeline you gain actionable intelligence which can be used to identify the quickest routes to grow revenue.

Of course, not all companies will have the same concepts and schemes in place so therefore their routes to increasing revenue will be different. That said, the principles we have laid out below will apply to most situations, and give you an insight into how you can optimize your sales pipeline for growth.

Table of Contents

Understanding a Deal’s Make-Up and Where to Optimize First

By reviewing how your deals have been successful you are able to get a better understanding of what caused that success and how to implement that across your pipeline to improve your overall effectiveness. The first step of this is looking at three key indicators across all your deals:

- Review where your highest win rates have been

- Review which deals have had the shortest sales cycles

- Identify which deals have the highest average deal values

By analyzing each of your closed-won deals across these points you start to build a matrix of what are your best performing deals, in terms of what took the least amount of resources to achieve. Based on this you can start to look at what connects these deals and work out if there are patterns that can be identified.

But this is just the starting point, by digging deeper into your successful deals you can build a map of what actually makes up a deal success for your specific business. Start by analyzing your data and seeking answers to these questions:

- Who or what is the company that was involved in the deal?

- What industry do they focus on?

- What are their verticals?

- What people are involved?

- What size is the company?

- What salespeople were involved in the deal?

- How did they communicate with the prospects?

- What were their relationships like?

- Did other salespeople enter into the deal to improve relationships?

Review how your salespeople are interacting with successful prospects allows you to identify what messaging and communication methods aided in the completion of the deals. Additionally, by looking at which salespeople were involved you can use lessons learned from how these salespeople communicate to coach your other reps on how to develop successful relationships with potential prospects. On the other hand, taking a look at the unsuccessful deals will also help you to identify the strengths and weaknesses of your salespeople improving your ability to match up your reps based on strengths.

Another aspect that can offer insights into your successful formula is the strength of prospect engagement. Having a strong level of engagement with your prospects is firmly tied to the size and likelihood of a successful deal. By increasing your engagement with your prospective contacts you are more likely to create solid relationships within your target accounts making it easier to move the deal forward. As such being able to connect various reps at different levels within a target company allows you to build relationships across the account increasing your connections to key decision-makers. Ultimately, we have seen that the more relationships clients have with their prospects they have improved successes, closed deals faster, and seen increased deal value.

The next stage is to start to bring in concepts and KPIs from other departments outside of sales specifically to expand your understanding. One of the key departments that compliments sales are, of course, marketing. By looking at visitors/prospects intent as they enter your process you can improve the way that sales outreach is performed to focus tighter on their needs and requirements. The intent is defined in different levels based on what their initial interaction was, if they entered the process from a demo request form they are a stronger qualified lead than if they had entered by a newsletter sign-up. By measuring against the marketing intent of the entry point you can get your reps to prioritize the higher-level prospects who are more likely to convert than those who are lower down the scale and require more investment of resources to convert.

Review The Losses

While being able to understand what made your deals successful provide you with the DNA of what should be a good deal for you, understanding why you lost deals is in some ways more important to understanding where your pipeline needs optimizing. Being able to review your losses and identify exactly why the opportunity didn’t result in a win can give you better insights than knowing how you won. Your unsuccessful attempts will highlight leaks in your pipeline process, where things could have been done to improve the process and lack of training or coaching opportunities for staff. As much as understanding your successes gives you insights to optimize your processes, your losses give you insights into where your weaknesses lay.

The first step in reviewing where your deals went wrong is to look at opportunities that were in the commit stage of your pipeline but didn’t cross the finish line. Unlocking why these opportunities didn’t complete is extremely important as they looked good until they didn’t. There will be some deals that ultimately didn’t complete due to reasons out of your control, such as the prospect decided not to implement the service or product you offer completely, or their budget was cut etc. These are not failures and not what you want to factor into your review. You want to look at any feedback you have received linked to your competitors, missing features or functionality, or pricing (why there was no ability to negotiate). If you are missing the reason behind the missed business follow up with your reps to see if you can get more clarity to aid you in your understanding. Work your way back across each stage of your pipeline identifying where each deal that failed happened and the reasons behind that.

Use Data Insights to Optimize your Pipeline For Growth

Working backwards like this you build a conceptualization of what makes up a successful deal and why other deals have failed that is unique to your business based on data from within your sales process. Armed with these insights you can then start to work through your current pipeline targets and categorize each opportunity to start to optimize your pipeline for growth.

Each prospective deal can then be assigned based on some basic principles that have been established within your analysis. Take a look at where each of your contact within your pipeline pool has come from this will give you a measure of their marketing intent and in turn an indication of where they are within their own decision-making process. Further to this, by looking at their engagement levels with any previous or automated communications you can further understand where the prospect sits in your process, this will then allows you to place a score around the likelihood of their conversion. As you have now socred that individual contact you can identify if they have are part of a company or account that you have already had contact with or have started negotiations with previously, adding additional relationships and further contact points to the target account. Through this analysis, you can gauge the likelihood of the opportunity progressing and how resource-intensive it would be, thus providing insight to prioritize the deal.

Use Data Insights to Build Sales and Marketing Alignment

By reviewing your sales process and how opportunities are won and lost you can feedback across your sales and marketing functions. While it is well-established that marketing and sales work collaboratively to achieve sales there isn’t always alignment between the two departments. Marketing will have their own ideas of what are qualified leads and will focus on those avenues, presenting Sales with leads that may not be as “conversion-ready” as marketing thinks. Whereas Sales told how warm or cold a prospect is based on their readiness to convert but don’t share that insight for Marketing to optimize their outreach or inbound communications. Creating a more symbiotic relationship between the two is a key outcome of reviewing how your pipeline functions.

Understanding your stages and what constitutes a warm lead Sales can improve Marketing’s targeting. Giving Marketing deeper insights into lead progression and where leads should be entered into the sales process rather than be kept in Marketing’s nurture process can drastically improve the way that leads are generated and increase the chances of conversion. Furthermore, with the insights you have gained, you can improve and optimize the nurture processes that marketing implements to improve effectiveness and fine-tune the way that your sales teams follow up.

Ultimately, improving the way in which insights and shared between the two departments will benefit your business and increase sales successes. With data-driven insights from key analysis of your owned data, you create not only a sales process that is driven by actionable data but a marketing machine that is driven the same way.

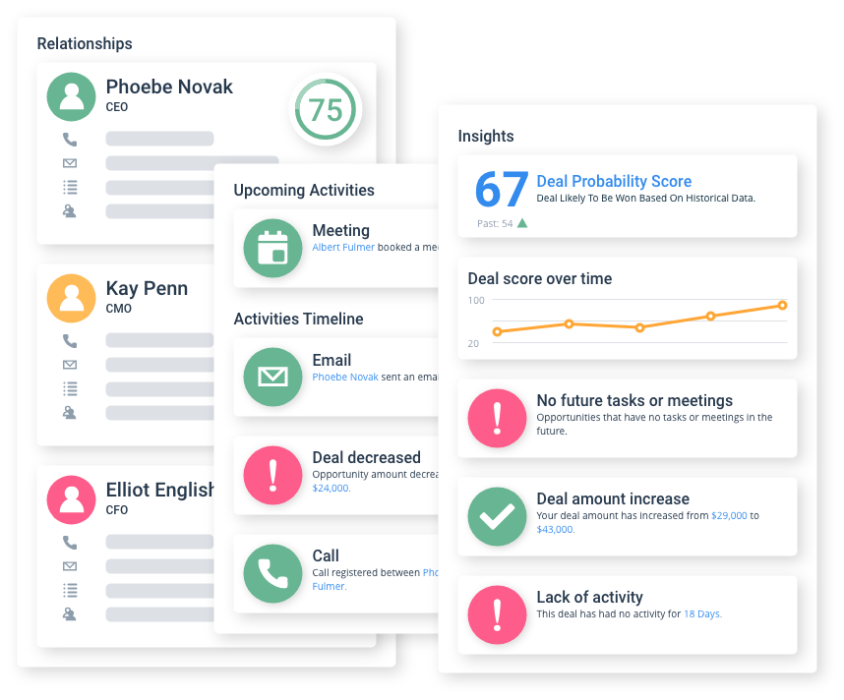

If you want to improve your analysis of your pipeline and gain data-driven insights that will optimize your sales and marketing efforts, give Ebsta’s Revenue Intelligence Platform a try. It will take the guesswork out of your analysis with solid insights that you can trust and take action on.