Share this article

Learn from the brightest minds how to predictably and efficiently grow revenue.

Related Content

5 Ways to Use the Ebsta Integration With HubSpot to Improve Sales Performance

How to improve adoption of HubSpot with Ebsta

B2B Sales Benchmarks: 2023 H1 Update

The latest update from the 2023 B2B Sales Benchmarks analysis of over $37bn in pipeline.

How to improve AE quota attainment (according to data)

23% of reps are contributing 83% of revenue. Here's how to solve it (with data)

The Ultimate Guide to Sales Forecasting in 2022

What is sales forecasting?

Sales forecasting is the process of estimating future revenue generated by your sales reps, teams, or company over a specified period.

In this guide, we cover:

- Forecasting around your business goals

- Why forecasting is important

- Who is responsible for sales forecasting

- How to forecast

- Methods of sales forecasting

- Metrics used in sales forecasting

- How things were done in the past

Forecasting around your business goals

Your sales forecast should be centered around your business goals. Your forecast will change depending on what goals are a priority for your business at the time. For example, start-ups might focus on landing new customers with big logos to create credibility.

Here are some common goals:

- Number of customers landed

- Improve brand identity and reputation

- Increasing customer satisfaction

- Maintaining a healthy cash flow

- Sustainable growth

Why is forecasting important?

Accurate sales forecasts can have a major impact on your business in a number of ways.

For one, they allow you to plan for the future. Accurate sales forecasts provide you with an indication of upcoming sales and profits. This information can then be used to allocate your resources accordingly enabling you to stay ahead of the curve and avoid any potential problems.

For example, if there are a lot of opportunities in your pipeline next quarter you want to anticipate these changes and be prepared for them. This might be in the form of hiring temporary salespeople to better target growth. This ensures you are able to cover the demand you are expecting to generate.

Whereas, if there are not so many opportunities lined up, this affects cash flow in the following quarter. Financial planning could be the be-all and end-all of your business. An accurate forecast allows your finance teams to adjust budgets accordingly as you do not want to overspend.

Accurate forecasting essentially allows you to make better financial decisions on how much you have to spend next quarter. When forecasts are inaccurate, leadership will hesitate to make decisions that delay growth.

On the opposite side of this, they overcommit to what their teams are realistically able to deliver. When these numbers are not met shareholders and C-level suite executives will not be happy, to say the least.

An accurate forecast also allows you to set new targets. By analyzing your potential deals, you can set realistic targets based on your data.

Who is responsible for sales forecasts?

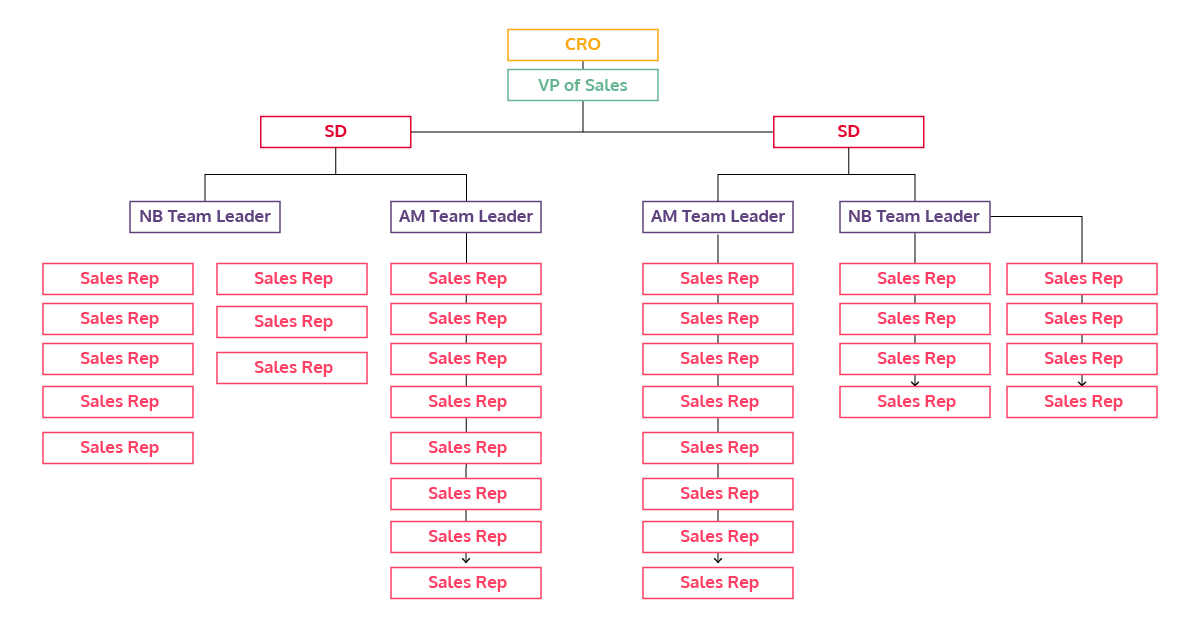

There is not one person who is responsible for producing a sales forecast. Think of it more as a hierarchy.

Let’s work from the bottom up.

So first, we have sales reps who report their own numbers to their managers. They are motivated by commission and are focused solely on the month at hand. Reps contribute to the inaccuracy of forecasts in a number of ways. Sales reps minimize their own risk by lowballing high-value deals.

For example, they may set the close date as the last day of the month or if a deal can come in this month they will set the close date for the next just in case.

This is an example of a gut feel forecast. One based on instinct, rather than cold hard facts. Gut feeling has its merits, but we don’t always trust our gut, and it’s never 100% accurate. As a result, this leads to inaccuracies starting from the very bottom of the hierarchy.

Then we have sales leaders who compile these forecasts to create team forecasts.

Team forecasts are then evaluated by sales directors who challenge everything that is not the deal value. They are less concerned about the current month and more concerned about the quarter. Every deal that is in for next month will be challenged to be brought into this month. Leaders will be looking to create momentum and a strong exit rate.

Next up, we have a VP of sales who is responsible for understanding and improving how everyone underneath them in the hierarchy is determining their forecasts.

And at the top of the hierarchy, we have a CRO who is responsible for allocating the budget based on these forecasts.

How to do it

Consistency is key when it comes to delivering an accurate sales forecast.

Developing a forecast cadence can give you that confidence.

A forecast cadence is a repeatable strategic process which has been proven to increase forecasting accuracy within a few percent. It gives you a structure to conduct your meetings to push your sales team to hit their individual goals as well as the business’.

A few examples of these meetings include; one-to-one coaching sessions, pipeline reviews and quarterly business reviews.

Why do you need a forecasting cadence?

It provides you with complete visibility of your pipeline health. You want everyone from your sales reps to the CRO to sing from the same hymn sheet. Giving everyone access to the same data results in a well-informed and more accurate forecast.

A forecasting cadence also establishes a routine and creates momentum. Sales reps know exactly what they need to report on and when. This consistency helps to easily identify issues as and when they happen, helping you to stay better prepared. Another benefit of building a repeatable process is that it makes it easier to onboard new staff members.

Improved visibility means you can identify if a manager is producing a consistently accurate report. This gives you the opportunity to better understand what is working well and what is not. This new information can then be leveraged and replicated with other managers resulting in marginal gains. In this situation, the marginal gain is a more accurate forecast.

Evaluating sales performance through pipeline reviews has the power to improve the accuracy of your sales forecast. It enables you to dig into the details of which forecasted opportunities were accurate – and which were not. It allows you to look into those incorrect ones, which can then be reviewed to understand why that call was made. These learnings can then be applied elsewhere.

For example, if you notice that only 27% of your opportunities result in a closed-won, this indicates your salespeople may be targeting leads that are showing low intent. With this information, you want to introduce a new process where your salespeople prioritize leads with high intent first.

In fact, we’ve come up with a 7 step process to help you to prioritize the deals that matter most, close deals faster, and improve your pipeline management processes.

Forecasting cadences create transparency and take more of a collaborative approach than other sales forecasting methods. Whilst building out your forecasting cadence, you will inevitably gain a deeper understanding of the sales process. Making it easier to spot the parts of your process that are not as efficient as they could be.

A forecasting cadence addresses inaccuracies at a rep level. This has a direct impact on improving forecasting inaccuracies on higher levels.

Methods of Sales Forecasting

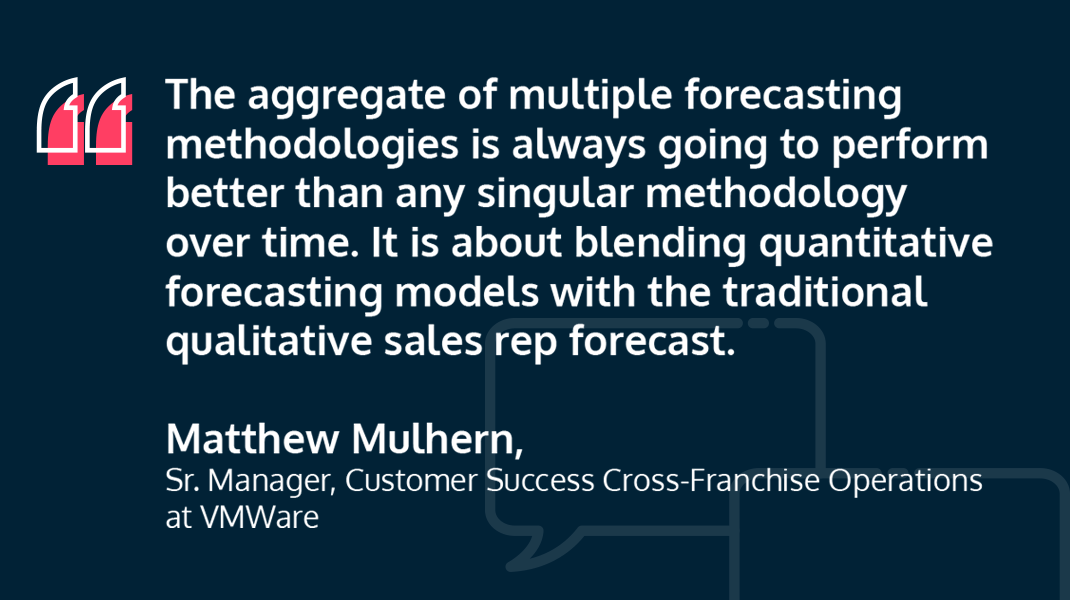

Watch the podcast here

Qualitative forecasting – This technique is based on the judgment of company experts who employ their knowledge of past performance to predict future performance. It focuses on opinions, judgment, and experience.

This approach is usually used when there is no historical data to rely on. For example, start-ups could employ this method.

There is no guarantee of the accuracy of this type of forecast as you are relying on an opinion. At the end of the day, opinions are just that. Opinions. They are open to bias and subjectivity.

Time-series forecasting – This technique relies on historical data to make predictions about the future and is all about identifying patterns. It considers historical data in chronological order and makes predictions based on the assumption that these patterns hold true. This is an example of quantitative forecasting.

The upside of time-series forecasts is that they are data-driven. However, if the data you are using is not accurate and if you do not have complete visibility of your pipeline then the likelihood of your forecast being off is incredibly high.

Causal model – This technique combines your historical data with a range of variables that might influence the future of your market segment. This method is based on a range of variables that are likely to influence the movement of the market in the near future.

The first step is to identify the current position of the company within that market. After this, you outline independent and dependent variables that are likely to influence your market over a set period of time.

An accurate causal forecast gives you the ability to prepare for the future. At the same time, an inaccurate forecast can throw you off course. If you have not considered a variable that is beginning to influence your market, this can contribute to a highly inaccurate forecast.

Top-down sales forecasting – This technique gives you a bird’s eye view of your business. The first step in this process is to identify the total addressable market (TAM). You then need to estimate how much of the market share you will be able to capture.

So, you are calculating revenue by multiplying the TAM by the percentage of the market share you aim to capture.

Here’s an example:

If you are in the SaaS space and your TAM is $700,000 and you can capture 4.5% of your market share then your forecast would predict $31,500.

A drawback of a top-down sales forecast is that it does not consider actual opportunities in your pipeline. Therefore, your forecast is not really backed by data.

Bottom-up sales forecasting – Managers and sales reps collaborate to come up with a number based on the opportunities in their pipeline. They do this by reviewing their pipeline and by looking at sales activity data.

A positive aspect of this method is it happens in real-time. However, if managers and reps do not have complete visibility of their pipeline, then this will be reflected in an inaccurate forecast.

Managers and reps would need to have access to information on how likely deals are to close, on the engagement on each account, how long the deal has been in your pipeline, etc. One way to get all of this information is by compiling it into a single score. Deal Scoring gives you a number between 0-100 based on several different factors so you can understand how likely a deal is to close. More on this later.

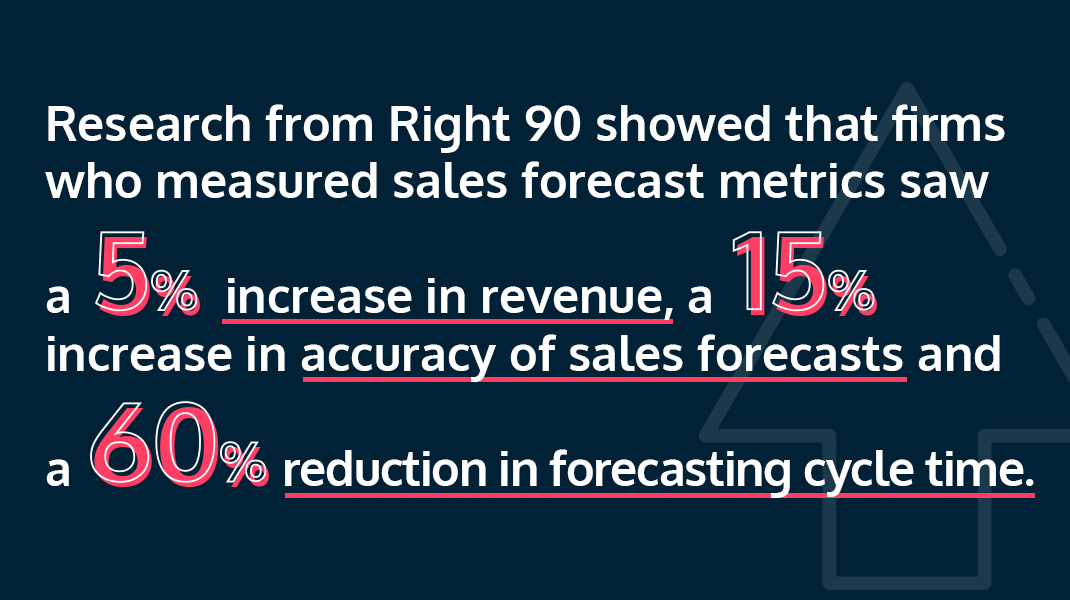

Metrics Used in Sales Forecasting

The world of sales revolves around hitting numbers. Without measuring sales performance it can be difficult to find ways to improve. Measuring the right sales metrics can drastically improve the performance of your sales reps.

A common mistake that is made by sales leaders is that they attempt to track as many metrics as possible. In this case, it is quality over quantity. Prioritizing the right metrics is more likely to result in an accurate forecast.

Quota – quota is an overall goal for an entire organization for a set period of time which outlines an agreed number of sales or an amount of revenue.

It lays the groundwork for sales metrics and forecasts. Having a quantifiable number to reach is easier to hit instead of taking a shot in the dark. It sets expectations and motivates sales reps.

The following metrics are what make up a traditional forecast:

Commit – also known as the ‘back yourself’ number. This is an amount that you can guarantee that you will be able to deliver.

Each salesperson has a different definition of how they come to this conclusion. With your salespeople on different pages, you can’t be too surprised when your forecast is not accurate.

Another factor that contributes to inaccurate commit submissions is sandbagging. This is when salespeople lower the expectations of management by low-balling what they are expecting to deliver. Then at the end of the month or quarter, there is a tendency to pile on deals, surprise leadership and make it seem like they have over-performed.

Upside – these are deals tracking well but have not yet been committed. Whilst there is a chance of this type of deal closing, there is no guarantee.

As previously mentioned, sales directors are constantly pushing for deals to be brought forward into the current month or quarter. For example, if there are 3 upside deals in your pipeline and your historical win rate is 1 out of 3, sales directors will push for at least one of these deals to be committed.

This is known as layering. Sales directors promise to deliver more than what is committed by sales reps to C-suite executives. The problem with layering is that these ‘layers’ are often not communicated back to the sales reps. With no visibility on what has been promised, their targets for the month or quarter are not aligned with management.

Upside deals are partially based on hope – and hope is not a strategy.

Best case – this number is the best possible outcome if everything was to go your way. These types of deals are qualified but need some work from your reps. The chances of best-case opportunities closing next month or quarter are high.

Deal Value – the amount of money a deal is worth.

Close Date – the date a deal is expected to close. When looking at a team forecast, this is measured on a week-by-week basis rather than a specific day.

Metrics used to create a more accurate forecast:

Without measuring the right metrics it can be difficult to accurately predict whether a deal is going to close or not. Here are some metrics to consider to move away from gut feelings and use data to predict the likelihood of a deal closing.

Engagement Scoring – this metric considers how engaged you are within an account and if you are engaged with the right stakeholders.

Age of the opportunity – this metric looks at how long an opportunity has been in your pipeline. Has it been in a stage too long?

Relationships – how many relationships have you built within an account? It can be difficult to identify which stakeholders you need to be building relationships with. Building an ideal customer profile is essentially a shortcut to pinpointing these stakeholders.

Next Action Date – do you have something in the diary for a meeting or a call? Is this meeting or call coming up soon?

At Ebsta, we have compiled all this information into one score. The Deal Score. This introduces a quantifiable way for sales reps and managers to understand how each deal is progressing.

It is all well and good measuring these key metrics to produce a forecast but these numbers have no value unless you have benchmarks to compare them against. Benchmarks give context and allow you to see how you are pacing. It allows you to continuously improve your process which gets you a step closer to achieving an accurate forecast.

How things were done in the past

The Gut Feel Forecast – this is where forecasts are based on a feeling rather than data. They rely on the judgment of experts leaving your forecasts open to bias.

According to Ukrainian folklore, they would check the size of a pig’s spleen to forecast the weather. You can’t get any closer to a gut-feeling forecast than that!

The Weighted Forecast – traditionally weights were assigned to each deal stage and these weights increase as the deal gets closer to being won or lost. This method is problematic because it does not reflect the true status of your pipeline.

Essentially, the main problem with these methods is inaccuracy. You will end up either over-forecasting or under-forecasting.

Over-forecasting is when your sales team underdelivers. This could result in employees losing their jobs or have a negative impact on your valuation.

Under-forecasting is when your sales team over-delivers. While an increase in cash flow is a positive thing, this can lead to your business making rash decisions that have not been thought through.

These methods have obvious limitations. One of the many limitations of these methods is that it is time-intensive. It takes a chunk of time for sales reps to produce these forecasts and then for a sales manager to compile a team forecast. Sales is a fast-paced environment with many components constantly changing. Even after a couple of hours, the forecast prepared will not reflect the pipeline. Traditional forecasting methods were slow, monotonous, and inaccurate.

Final Thoughts

Sales forecasting plays a pivotal role in the success of your business. It allows you to move a step closer to becoming more predictable. Predictability enables you to build on success and an accurate forecast gives you the tools you need to continue to grow and scale your business.